1

Please refer to important disclosures at the end of this report

1

1

RITES is a wholly owned Government Company, a Miniratna (Category – I)

Schedule ‘A’ Public Sector Enterprise. It is a leading player in the transport

consultancy and engineering sector in India and the only company having

diversified services and geographical reach in this field under one roof.

RITES has an experience spanning 43 years and has undertaken projects in

over 55 countries including Asia, Africa, Latin America, South America and

Middle East regions.

Healthy order book with diversified clientele base: RITES’ order book stood at

~`4,800cr as of March 2018 (3.5X of FY17 top-line). The company receives orders

on nomination/single tender basis on regular intervals from its clients such as

national government, governmental instrumentalities and public sector

enterprises.

Strengthening EPC/Turnkey business: RITES intends to increase its revenue

mix in Turnkey projects owing to new investments in electrification and railway

infrastructure. So far RITES has been awarded two projects for new railway lines

and two projects for railway electrification.

Preferred consultancy organization of GOI including Indian Railways: RITES

was incorporated by the Ministry of Finance (MoR) and is a nominated

organization of the Indian Railways for export of railway locomotives, coaches

and other equipments, which are manufactured by the Indian Railways (except

exports to Malaysia, Indonesia and Thailand). It is also a nominated organization

for inspection of various materials and equipment purchased by the Indian

Railways.

Outlook & valuation: In terms of valuations, pre-issue PE works out to 12x of

annualized FY18 EPS `17 (at the upper end of the issue price band), which is

reasonably priced considering (a) 3.5x of order book with execution capability

and experienced management, (b) maintaining the RoE level in the range of 17-

18%, (c) diversified client base and (d) increasing opportunity of revenue from

Railways due to new investment in electrification and infrastructure. Given that

the RITES is a preferred consultant of Indian Railways along with other

government authorities with exposure in international operation and fair

valuation of issue, we recommend SUBSCRIBE to issue.

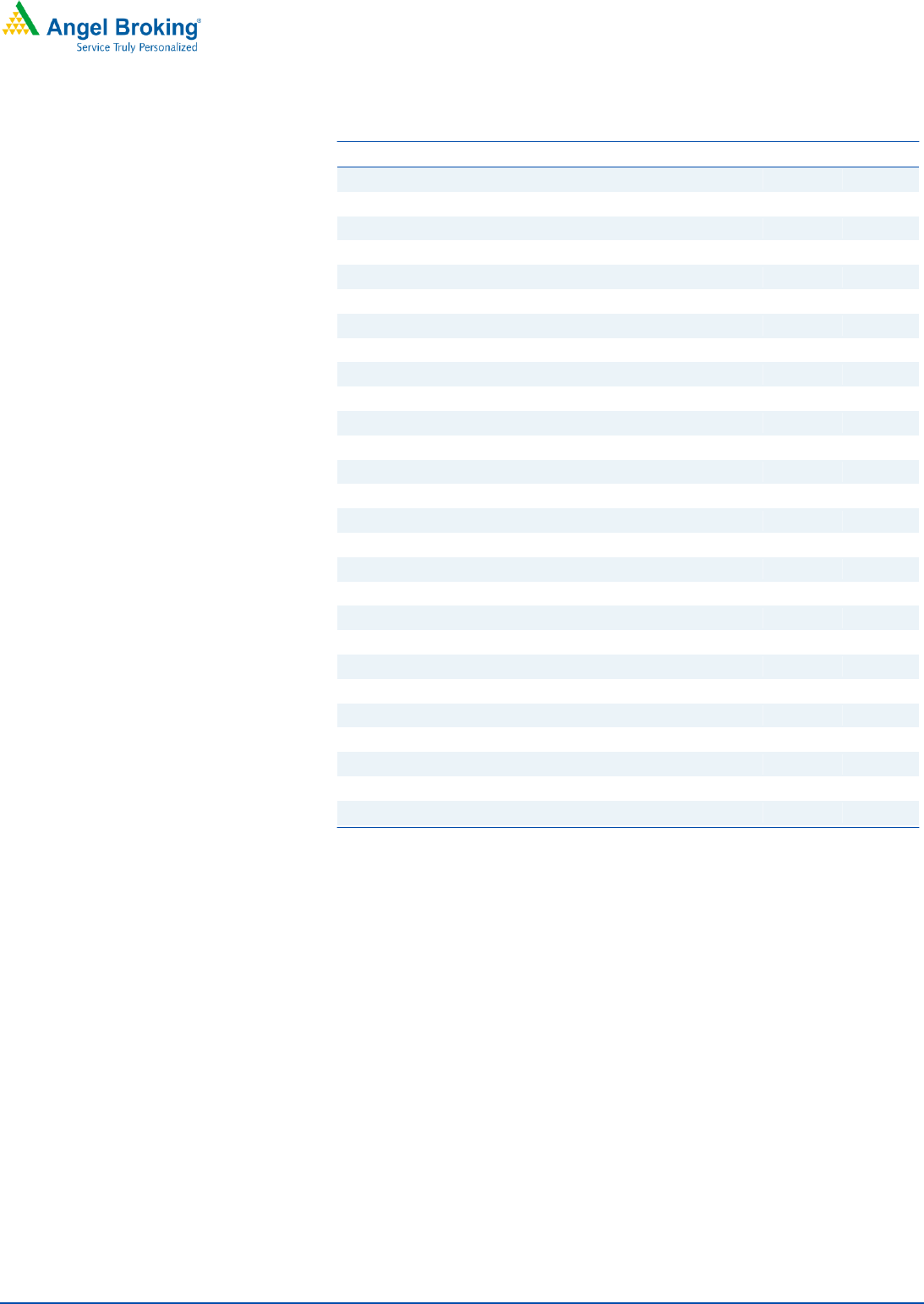

Key Financial

Y/E March (` Mn)

FY2014

FY2015

FY2016

FY2017

Net Sales

10,964

10,126

10,905

13,533

% chg

15

(8)

8

24

Net Profit

2,585

3,140

2,815

3,623

% chg

9

21

(10)

29

EBITDA (%)

25.6

34.3

32.7

26.5

EPS (`)

13

16

14

18

P/E (x)

14

12

13

10

P/BV (x)

3

2

2

2

RoE (%)

18

19

15

18

RoCE (%)

17

18

15

14

EV/EBITDA

7

5

6

7

Source: RHP, Angel Research; Note: Valuation ratios based on pre-issue outstanding shares and at upper end of

the price band

SUBSCRIBE

Issue Open: June 20, 2018

Issue Close: June 22, 2018

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters

87%

Others

13%

Issue Details

Face Value: `10

Present Eq. Paid up Capital: `200cr

Offer for Sale: **2.52cr Shares

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: `200cr

Issue size (amount): *`460 -**466cr

Price Band: `180-185

Lot Size: 80 shares and in multiple

thereafter

Post-issue implied mkt. cap: *`3600cr -

**`3700cr

Promoters holding Pre-Issue: 100%

Promoters holding Post-Issue: 87%

*Calculated on lower price band

** Calculated on upper price band

Book Building

`.6 per share discount to individual

RITES Ltd.

IPO Note | Consultancy Services

June 18, 2018

2

RITES Limited | IPO Note

June 18, 2018

2

Company background

RITES Limited (“RITES”) is a wholly owned Government Company, a Miniratna

(Category – I) Schedule ‘A’ Public Sector Enterprise. It is a leading player in the

Transport Consultancy and Engineering sector in India and the only company having

diversified services and geographical reach in this field under one roof. RITES has an

experience spanning 43 years and has undertaken projects in over 55 countries

including Asia, Africa, Latin America, South America and Middle East regions. RITES is

the only export arm of Indian Railways for providing rolling stock overseas (other than

Thailand, Malaysia and Indonesia). RITES is a multidisciplinary engineering and

consultancy organization providing diversified and comprehensive array of services

from concept to commissioning in all facets of transport infrastructure and related

technologies.

Since inception in 1974, RITES has evolved from being a transport infrastructure

consultancy and quality assurance services provider and has developed expertise in:

• Design, engineering and consultancy services in transport infrastructure sector with

focus on railways, urban transport, roads & highways, ports, inland waterways, airports

and ropeways.

• Leasing, export, maintenance and rehabilitation of locomotives and rolling stock.

• Undertaking turnkey projects on engineering, procurement and construction basis

for railway line, track doubling, 3rd line, railway electrification, up-gradation works for

railway transport systems and workshops, railway stations, and construction of

institutional/residential/ commercial buildings, both with or without equity

participation.

• Wagon manufacturing, renewable energy generation and power procurement for

Indian Railways through their collaborations by way of joint venture arrangements,

subsidiaries or consortium arrangements.

In India, company’s clients include various central and state government ministries,

departments, instrumentalities as well as local government bodies and public sector

undertakings.

3

RITES Limited | IPO Note

June 18, 2018

3

Issue Details

The company is raising ~`460cr through a offer for sale in the price band of `180-185

with Retail and Employee Discount of Rs6/ per share. The offer will constitute ~12.6%

of the post-issue paid-up equity share capital of the company, assuming the issue is

subscribed at the upper end of the price band. The company is offering 2.52cr shares

that are being sold by Government of India (GOI).

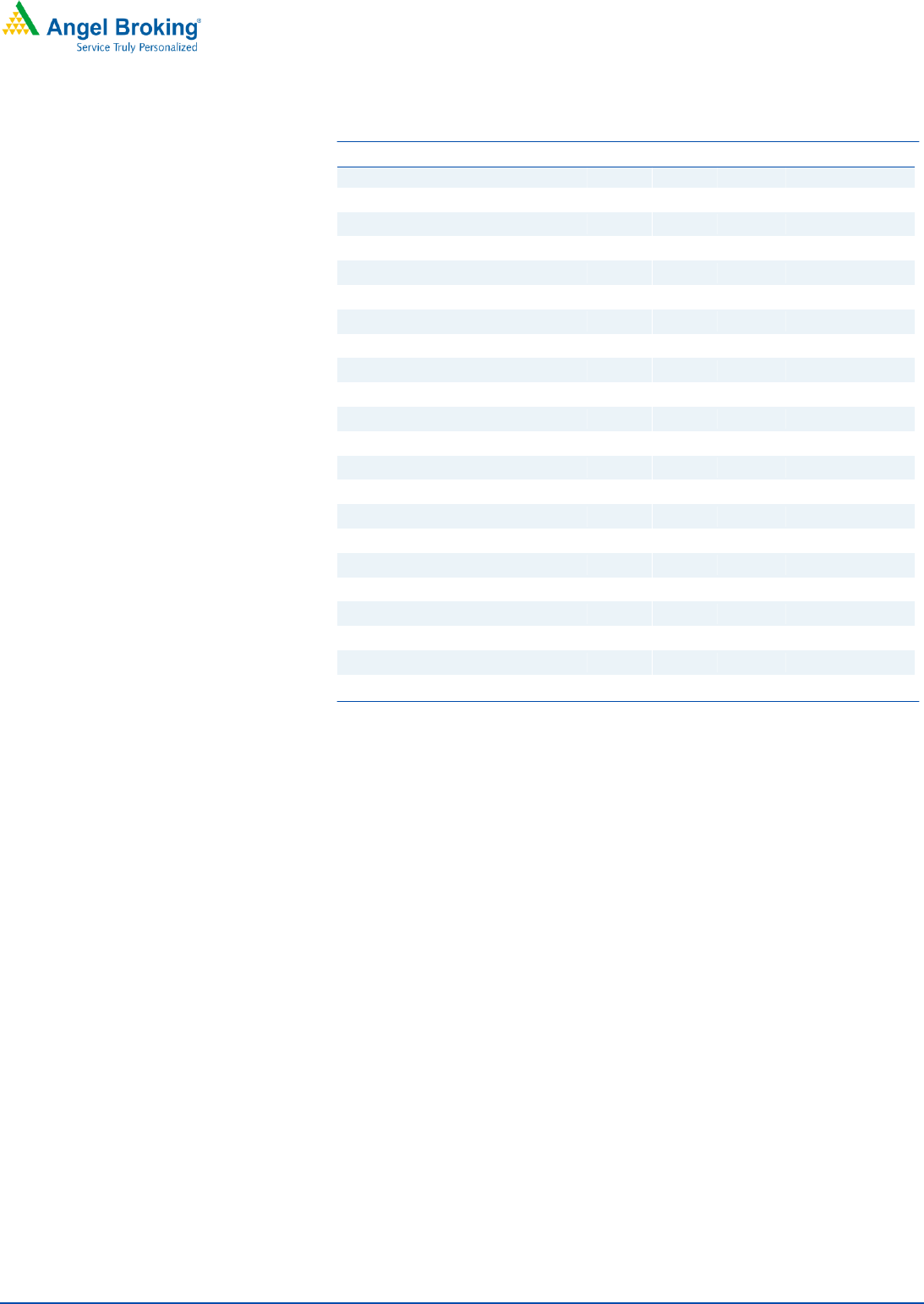

Exhibit 1: Pre and Post-IPO shareholding pattern

No of shares (Pre-issue)

%

No of shares (Post-issue)

%

Promoter (GOI)

20,00,00,000

100%

17,48,00,000

87%

Other

0

0%

2,52,00,000

13%

Total

20,00,00,000

100%

20,00,00,000

100%

Source: RHP, Angel Research; Note: Calculated on upper price band

Objects of the offer

As the issue is an offer for sale, RITES will not receive any proceeds from the offer.

Key Management Personnel

Mr. Rajeev Mehrotra: He is the Chairman and Managing Director of RITES since

October 11, 2012. He holds a Bachelor’s Honors degree in Accountancy and Business

Statistics from Rajasthan University and is qualified as a Fellow Member of the Institute

of Cost Accountants of India. He has received a certificate of participation for the

course titled ‘Financial Management Training Program for Electric Utilities held from

April 18, 1994 to May 20, 1994 as offered by the Southern Electric International and

Global Utilities Institute, Samford University, USA. He has been associated with the

Company since October 12, 2007. He has over 34 years of experience, out of which he

has over 10 years of experience at the Board level in RITES. He has also worked with

the National Hydroelectric Power Corporation Limited, Faridabad and Power Finance

Corporation Limited New Delhi in various capacities.

Mr. Arbind Kumar: He is the Director (Projects) of RITES since June 01, 2012. He holds

a Bachelor’s degree in Civil Engineering from Muzaffarpur Institute of Technology, a

Diploma in Management from the Indira Gandhi National Open University, and is

qualified as a Life Fellow of the Institution of Permanent Way Engineers (India). He has

been associated with RITES since January, 2001. He has over 35 years of experience.

He has also worked with the Indian Railways in various capacities, a private company

in Malaysia through RITES, and for the Sultanate of Oman.

Mr. Ajay Kumar Gaur: He is a Director (Finance) of RITES since September 02, 2013.

He holds a Bachelor’s degree in Commerce (Honours). He is qualified as a fellow

Member of the Institute of Chartered Accountants of India. He has been associated

with RITES since January 21, 1985. He has over 33 years of experience. He has also

worked with Container Corporation of India Limited.

4

RITES Limited | IPO Note

June 18, 2018

4

Mr. Mukesh Rathore: He is a Director (Technical) of RITES since December 01, 2016.

He holds a Bachelor’s degree in Mechanical Engineering from the University of

Jabalpur and is qualified as a Fellow Member of the Institution of Engineers (India). He

has been associated with RITES since April, 2000. He has over 36 years of experience.

5

RITES Limited | IPO Note

June 18, 2018

5

Investment Argument

Healthy order book with diversified clientele base

RITES’ current order book as of March 31, 2108 stands at ` 4,818.6cr, which is 3.5x of

FY17 revenue, which gives strong revenue visibility going forward. RITES has long

standing history of business relationships and collaboration with several central and

state government ministries, departments, corporations, authorities and public sector

undertakings. As a result, RITES, from time to time has been allocated projects on

nomination/single tender basis. RITES is one of the agencies of the Indian Railways for

exporting rolling stock, from India, customized for specific client requirements and

components as manufactured by the Indian Railways (except exports to Malaysia,

Indonesia and Thailand) and for inspections of materials and equipment as procured

by the Indian Railways.

RITES’ domestic as well as overseas clients typically are national government,

governmental instrumentalities and public sector enterprises. Such governments,

governmental agencies and public sector undertakings are engaged in large scale

infrastructure planning and development both in India and abroad. RITES also

undertakes and execute projects funded by multilateral funding agencies.

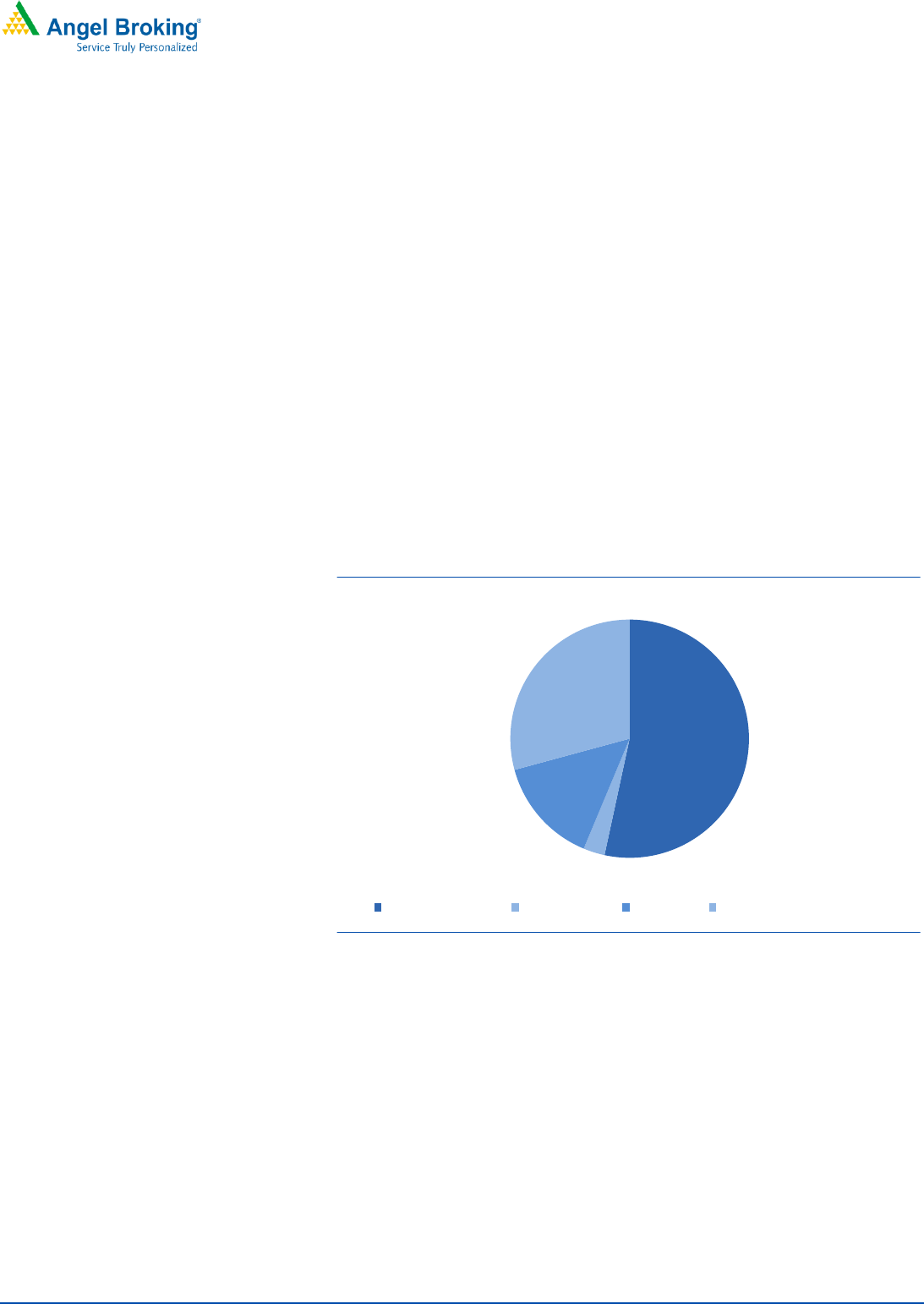

Exhibit 2: RITES order book mix FY18

Source: RHP, Angel Research

Experienced management personnel and technically qualified team

RITES is led by an experienced and well – qualified management team. The

management team plays a significant role in formulating the company’s business

strategies, accounting procedures and internal control and policies, and has been

instrumental in their growth of operations and consistent performance. RITES had a

total of 3,349 employees as on March 31, 2018. The company has an in–house team

of expert engineers specializing in civil, mechanical, metallurgy, chemical, electrical,

signal & telecom engineering, and specialists in transport and economics, quality

assurance, environment engineering, information technology, finance and general

management. The senior management has an average experience of about 33 years

and they have a pool of 1,400 skilled engineers/ professionals of executive cadre on

their permanent roll. The company also sources requisite manpower from the Indian

2,572.09

140.65

697.74

1,408.20

Order book Mix (` Cr.)

Consultancy Services

Leasing Services

Export Sales

Turnkey Construction Projects

6

RITES Limited | IPO Note

June 18, 2018

6

Railways and other government ministries and departments, both on deputation and

permanent basis, according to requirements.

Strengthening the EPC/Turnkey business

RITES has been awarded projects on nomination basis from MoR for construction of

railway lines and electrification of existing/new railway lines and up-gradation of

railway workshops on a fixed fee basis. In these contracts, RITES get fees as a certain

percentage of the cost of the project executed. So far, RITES has been awarded 2

projects for new railway lines and 2 projects for railway electrification. Considering the

extent of new investments in electrification and railway infrastructure, RITES intends to

strengthen its organization for taking more such projects.

Expanding operations in power procurement and renewable energy sector

In order to assist the Indian Railways meet its stipulated target for procurement of

renewable energy, the Indian Railways and RITES has set up a company i.e. Railway

Energy Management Company Limited (“REMCL”), with the objective of synergizing

the technical resource base of RITES and for reducing the carbon footprint of the

Indian Railways through utilization of green energy. RITES holds 51% of issued and

paid–up equity share capital of REMCL. REMCL provides project management and

other consultancy services for the Indian Railways with regard to setting up of wind

energy projects, solar energy projects, power procurement and construction of

transmission lines connected to the Inter–State Transmission System (ISTS). REMCL has

commissioned a wind power project of capacity 26 MW in Jaisalmer, Rajasthan and

has also concluded power procurement contracts for approximately 1,175 MW across

various states in India. Further, the National High Speed Rail Corporation Limited has

mandated REMCL to undertake techno–economic viability studies and related surveys

of power sourcing arrangements for their requirements.

Expanding international operations

RITES intends to continue expanding its international service offerings in order to

acquire new clients. Over the years, RITES has expanded its service offerings to address

new market opportunities and macroeconomic trends arising in the infrastructure

sectors. RITES, recently has been appointed by the Government of Mauritius as a

consultant for implementing light rail project in Mauritius and also to prepare a

detailed project report on Trident Port project. RITES is working in Nepal on 2

integrated check-posts at Birgunj and Biratnagar, and is conducting construction

supervision services of a road project in Botswana through its Subsidiary, RITES

(AFRIKA).

7

RITES Limited | IPO Note

June 18, 2018

7

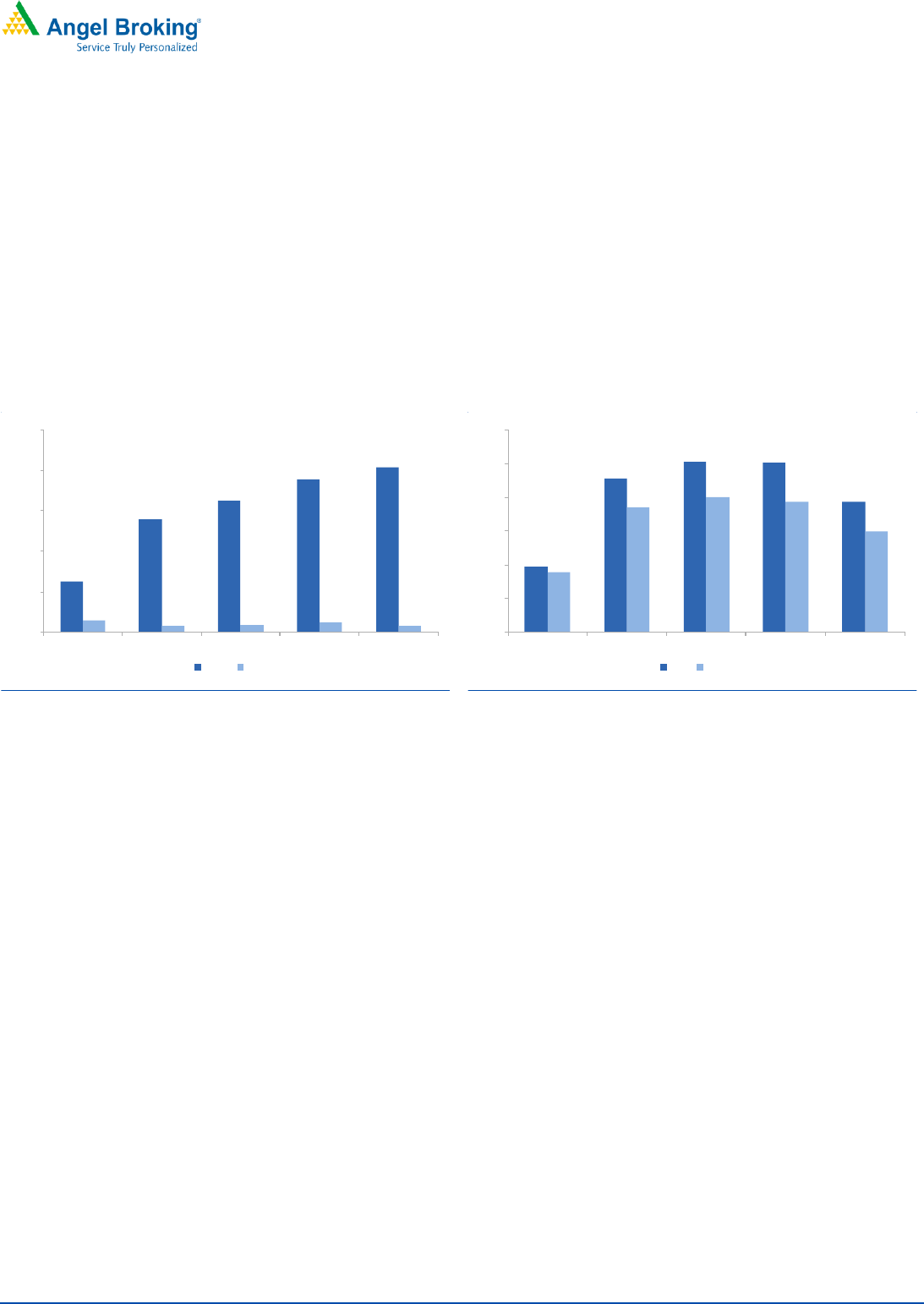

Strong financial performance, healthy balance sheet

RITES has been consistently profitable over the last 5 years and has paid dividends

regularly to shareholders. The company’s stable financial position enables it to satisfy

the minimum financial eligibility criteria for bidding in projects which generally

comprise of financial parameters such as net worth and profitability for various

projects across all market segments. As per the Restated Financial Information, the

total income has grown at a CAGR of 9.61% from `1,083.05cr in FY13 to `1,563.27cr in

FY17 and PAT has grown at a CAGR of 11.61% from `233.06cr to `361.66cr during the

same period.

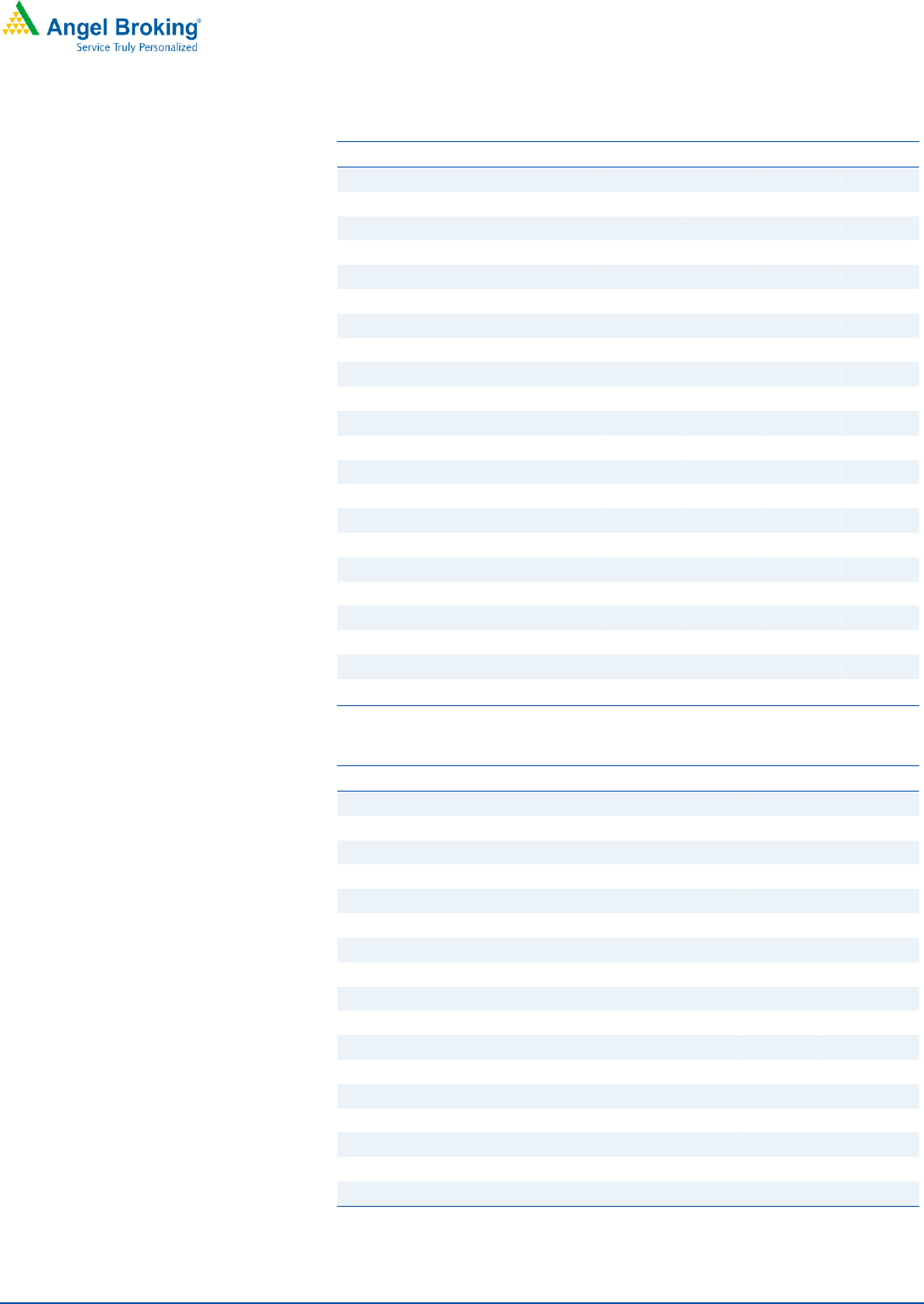

Exhibit 3: Healthy Balance sheet (`cr)

Source: RHP, Company

Exhibit 4: Return ratio

Source: RHP, Company

634

1402

1629

1883

2037

144

79

94

121

83

0

500

1000

1500

2000

2500

FY13

FY14

FY15

FY16

FY17

Equity

Debt

10%

23%

25%

25%

19%

9%

19%

20%

19%

15%

0%

5%

10%

15%

20%

25%

30%

FY13

FY14

FY15

FY16

FY17

ROE

ROCE

8

RITES Limited | IPO Note

June 18, 2018

8

Outlook & valuation:

In terms of valuations, pre-issue PE works out to 12x of annualized FY18 EPS `17 (at

the upper end of the issue price band), which is reasonably priced considering (a) 3.5x

of order book with execution capability and experienced management, (b) maintaining

the RoE level in the range of 17-18%, (c) diversified client base and (d) increasing

opportunity of revenue from Railways due to new investment in electrification and

infrastructure. Given that the RITES is a preferred consultant of Indian Railways along

with other government authorities with exposure in international operation and fair

valuation of issue, we recommend SUBSCRIBE to issue.

Key Risks

High Dependence on Railway orders

RITES receives most of the orders from the Railways segment, hence any slowdown in

railway spending may adversely impact the financial performance of the company.

Currency risk

Over 25% of RITES’ revenue comes from export sales, any adverse fluctuation in

movement of currency may impact earnings of the company.

9

RITES Limited | IPO Note

June 18, 2018

9

Income statement

Y/E March (` Mn)

FY2014

FY2015

FY2016

FY2017

Total operating income

10,964

10,126

10,905

13,533

% chg

7

(8)

8

24

Total Expenditure

8,154

6,657

7,341

9,951

Raw Material

4,706

2,749

3,270

4,735

Personnel

2,707

3,245

3,410

4,169

Others Expenses

742

664

662

1,046

EBITDA

2,810

3,469

3,564

3,582

% chg

29

23

3

1

(% of Net Sales)

26

34

33

26

Depreciation& Amortisation

203

262

346

383

EBIT

2,606

3,207

3,217

3,200

% chg

29

23

0

(1)

(% of Net Sales)

24

32

30

24

Interest & other Charges

0

0

47

113

Other Income

1,270

1,464

1,362

2,099

(% of PBT)

33

31

30

41

Extraordinary Items

(27)

10

(26)

(115)

Share in profit of Associates

-

-

-

-

Recurring PBT

3,849

4,682

4,506

5,071

% chg

18

22

(4)

13

Tax

(1,244)

(1,560)

(1,676)

(1,454)

PAT (reported)

2,605

3,121

2,830

3,617

Adj PAT

2,585

3,140

2,815

3,623

% chg

12

20

(9)

28

(% of Net Sales)

24

31

26

27

Basic & Fully Diluted EPS (Rs)

13

16

14

18

% chg

9

21

(10)

29

Source: Company, Angel Research

10

RITES Limited | IPO Note

June 18, 2018

10

Balance Sheet

Y/E March (` Mn)

FY2014

FY2015

FY2016

FY2017

SOURCES OF FUNDS

Equity Share Capital

1000

1000

1000

2000

Reserves& Surplus

13251

15762

17635

18411

Shareholders Funds

14251

16762

18635

20411

Total Loans

823

886

2122

1915

Other Liab & Prov

1211

1219

1266

1576

Total Liabilities

16285

18867

22023

23902

APPLICATION OF FUNDS

Net Block

1968

2105

4185

4052

Capital Work-in-Progress

192

257

70

33

Investments

2000

2000

1700

1200

Current Assets

24613

24472

31031

34021

Inventories

175

67

131

504

Sundry Debtors

3258

3808

5355

4645

Cash own fund

363

2570

2620

2647

Cash client fund

20817

18028

22925

26225

Loans & Advances

1833

1775

3017

2394

Other Assets

5755

5445

4085

6322

Current liabilities

20078

17187

22066

24121

Net Current Assets

4535

7285

8965

9900

Other Non Current Asset

Total Assets

16285

18867

22023

23902

Source: Company, Angel Research

Cash Flow

Y/E March (` Mn.)

FY2014

FY2015

FY2016

FY2017

Profit before tax

3,850

4,682

4,506

5,071

Depreciation

22

35

34

36

Change in Working Capital

1,980

2,489

2,482

5,528

Interest / Dividend (Net)

(973)

(1,068)

(1,080)

(979)

Direct taxes paid

(1,270)

(1,394)

(1,845)

(1,666)

Others

(2,898)

(3,648)

(3,461)

(4,128)

Cash Flow from Operations

711

1,096

637

3,862

(Inc.)/ Dec. in Fixed Assets

(488)

(1,001)

(1,941)

(211)

(Inc.)/ Dec. in Investments

(1,104)

2,696

684

(83)

Cash Flow from Investing

(1,592)

1,696

(1,257)

(294)

Issue of Equity

-

-

-

-

Inc./(Dec.) in loans

-

-

1,206

372

Others

(653)

(533)

(866)

(2,517)

Cash Flow from Financing

(653)

(533)

340

(2,146)

Inc./(Dec.) in Cash

(1,534)

2,259

(279)

1,422

Opening Cash balances

1,898

364

2,622

2,343

Closing Cash balances

364

2,622

2,343

3,765

Source: Company, Angel Research

11

RITES Limited | IPO Note

June 18, 2018

11

Key Ratios

Y/E March

FY2014

FY2015

FY2016

FY2017

Valuation Ratio (x)

P/E (on FDEPS)

14.3

11.8

13.1

10.2

P/CEPS

1.3

1.1

1.2

0.9

P/BV

2.6

2.2

2.0

1.8

EV/Sales

1.9

1.6

2.1

1.8

EV/EBITDA

7.3

4.6

6.3

6.9

EV / Total Assets

1.3

0.9

1.0

1.0

Per Share Data (Rs)

EPS (Basic)

12.9

15.7

14.1

18.1

EPS (fully diluted)

12.9

15.7

14.1

18.1

Cash EPS

13.9

17.0

15.8

20.0

DPS

2.7

3.1

6.8

6.7

Book Value

71.3

83.8

93.2

102.1

Returns (%)

ROCE

17.3%

18.2%

15.5%

14.3%

Angel ROIC (Pre-tax)

21%

25%

20%

17%

ROE

18.1%

18.7%

15.1%

17.7%

Turnover ratios (x)

Inventory / Sales (days)

6

2

4

14

Receivables (days)

108

137

179

125

Payables (days)

36

31

30

23

Working capital cycle (ex-cash) days)

78

109

153

116

Source: Company, Angel Research

12

RITES Limited | IPO Note

June 18, 2018

12

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material,

there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.